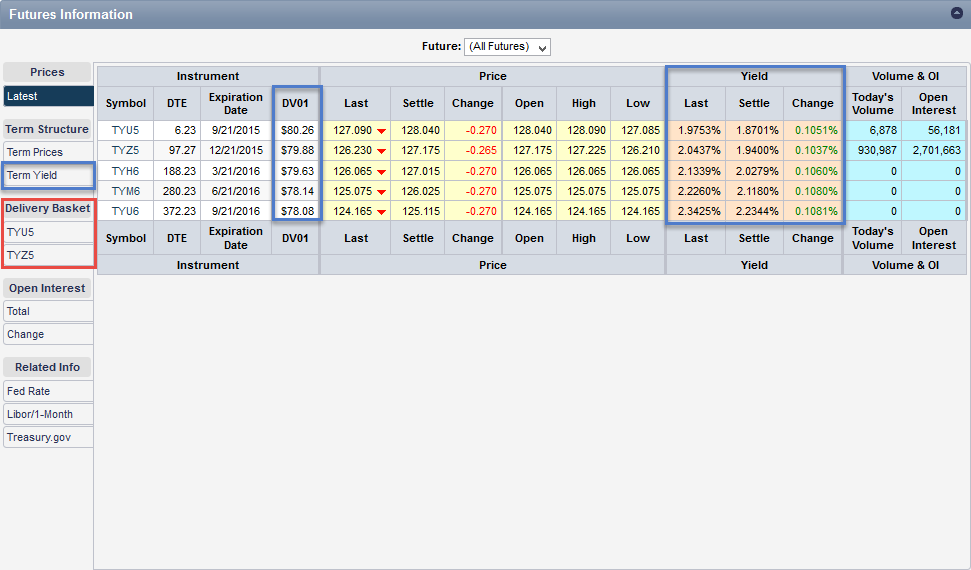

QuikStrike now displays the current and settle values for yield and DV01 (dollar value of a basis point) on the Futures Information page. The four callout boxes on the following graphic highlight the new treasury specific information.

The DV01 has always been a “behind the scenes” number in QuikStrike. However, now that we are calculating this value each day, we wanted to give it the attention it deserves. As an essential part of the basis point volatility (BPV) calculation for treasuries, an accurate and up-to-date value provides users with our most accurate BPV calculation to date.

With the yield now available in QuikStrike, users have one more way to look at futures levels and/or create strategies. For instance, instead of a strangle with references to strike prices, you can create these spreads with the yield or its range it mind (by seeing the yield equivalents of each strike). It’s one more way Of using QuikStrike to build strategies or just generally think about the market.

Each night, the yield and DV01 are calculated from the current CTD (cheapest-to-deliver) given the existing basket of deliverable treasuries. This (settlement) yield and DV01 will be used to calculate new yield values as the futures move throughout the following trading day. NOTE: This yield will soon be displayed wherever a futures price or table is available. And, Pricing Sheets will have yield values for each strike.

You will also notice, in the red box, a tabbed section named Delivery Basket. Each currently active future will have a corresponding tab with a list of deliverable treasuries into that future. Each list will be ordered with the CTD at the top in ascending DV01 order.

A Term Yield tab has also been added plotting the yields by future.

Should you have any questions or suggestions or would just like to chat about QuikStrike, please let us know.