In our most recent post, we referenced the Greek help in the QS.EDU section of QuikStrike. Understanding what each Greek value means and how they are affected by changes in the strike price, future price, volatility, days to expiration and interest rates is imperative in order to trade options successfully.

The Calcs 101 tab thoroughly explains how to calculate Delta, Gamma, Vega and Theta, as well the Rent value. Let’s take a look at the Delta page to give you an idea of what to look for on each page.

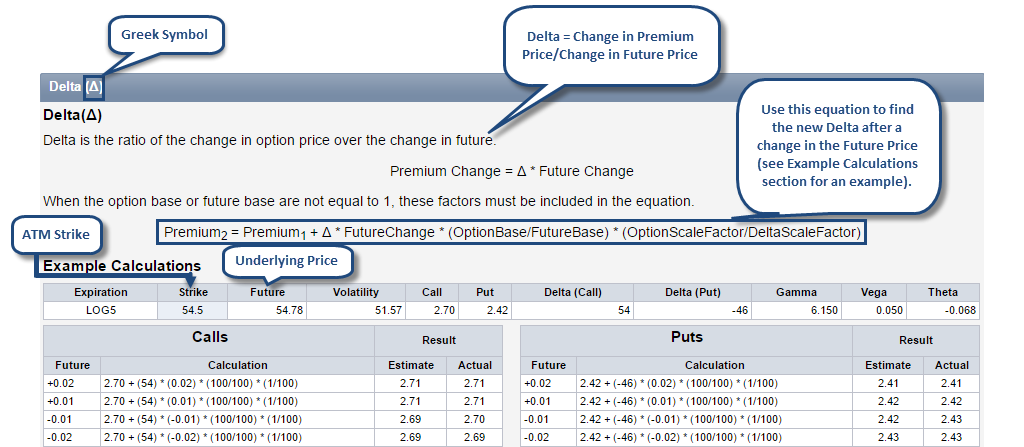

The first thing you’ll notice is the header of the page (Delta) with the Greek symbol next to it. Beneath the header will be the definition and equation for how to calculate the selected Greek value. Becoming familiar with the formula to calculate all the Greeks and the Rent value helps you understand where risk can come from, create expectations for a certain position and reduce the number of surprises one encounters when evaluating the behavior of an option’s price.

The strike noted on the page is the ATM strike, the future is the current underlying price and the current volatility is also used. On this particular page, you’ll see the Delta value for both calls and puts, followed by the other Greeks. Note that the strike information shown is always the current ATM strike for whatever expiration is currently selected.

In the Example Calculations section, you can use the equation to see how the Delta changes when there is a change in the underlying price. In order to calculate the new Delta, it’s important to understand all the variables (and constants) in the equation.

Before reviewing this sample calculation, we need to define the inputs into the equation. We know the Premium is the price you pay for an option and the Future Change is the change in future price. However, you may not be familiar with future and option base and the scale factors. The future and option base are the numeric bases for the fractional portion of the future price. These values only apply for treasuries in which the option base is 64 and the future base is 32. Understanding scale factors is fairly simple; they are used to scale the output of the pricing models for display. To see how scale factors differ from product to product, check out the Contract Specs → Product Properties page in QS.EDU.

Now let’s dive into the calculation. We’ll use first item in the call column when the future price rises .02. Plug in the variables into the equation below to find the new Premium:

- Premium1: 2.70

- Delta: 54

- Future Change: 0.02

- Option Base: 100

- Future Base: 100

- Option Scale Factor: 1

- Delta Scale Factor: 100

Premium2 = Premium1 + Δ * FutureChange * (OptionBase/FutureBase) * (OptionScaleFactor/DeltaScaleFactor)

2.71 = 2.70 + (54) * (0.02) * (100/100) * (1/100)

If you’ve correctly used the equation, you’ll calculate Premium2 to be 2.71.

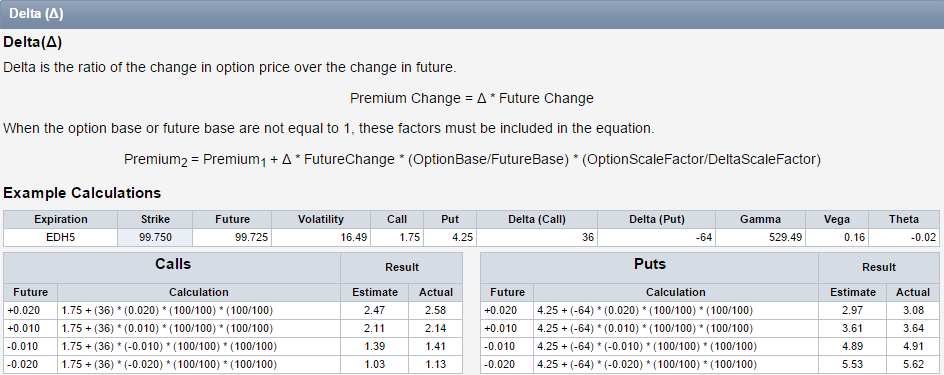

As you may have noticed, this particular Calcs 101 page was for American Crude Oil. It’s important to understand that every page example is specific to the product and has the actual, current ATM information for that product. Let’s take a look at the Calcs 101 page for Eurodollars.

Do you notice anything different from the American Crude Oil Calcs 101 page? Remember to look at all of the inputs we plugged into the equation. The Option Scale Factor for Eurodollars is 100, while for American Crude Oil it was 1. Always remember to check to see if you are using the right equation before doing any calculations.

Do you find the Calcs 101 tab to be educational? Are there any further questions we can answer about how to calculate the Greeks? We’re here to help. Send us a message at [email protected]. Thanks for taking the time to read our blog!