by nhoward | Jan 21, 2015 | QuikStrike Help

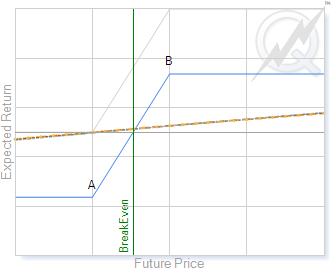

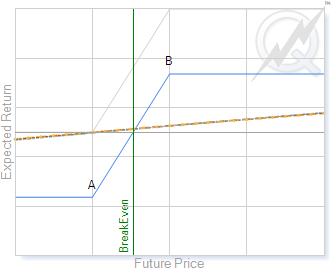

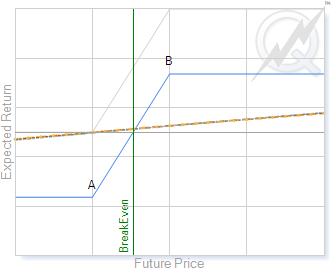

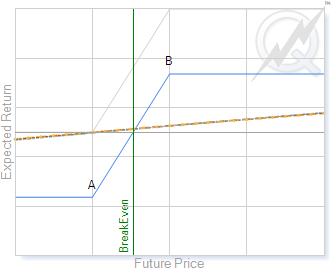

If you’ve read the blog post about our Standard Pricing Sheet, it’s time to try out our Strike Detail Sheet. Now that you know how to find call, put and straddle prices, view Greek values associated with those positions and manipulate inputs in a theoretical pricing...

by nhoward | Jan 12, 2015 | QuikStrike Help

Remember when you initially logged into QuikStrike? The Standard Pricing Sheet was the first page you saw, and that’s not by mistake. The Standard Pricing Sheet, and all the other pricing sheets, are structured in a way that allow our users to manipulate them quickly...