by nhoward | Jan 15, 2015 | Options Info, QuikStrike News

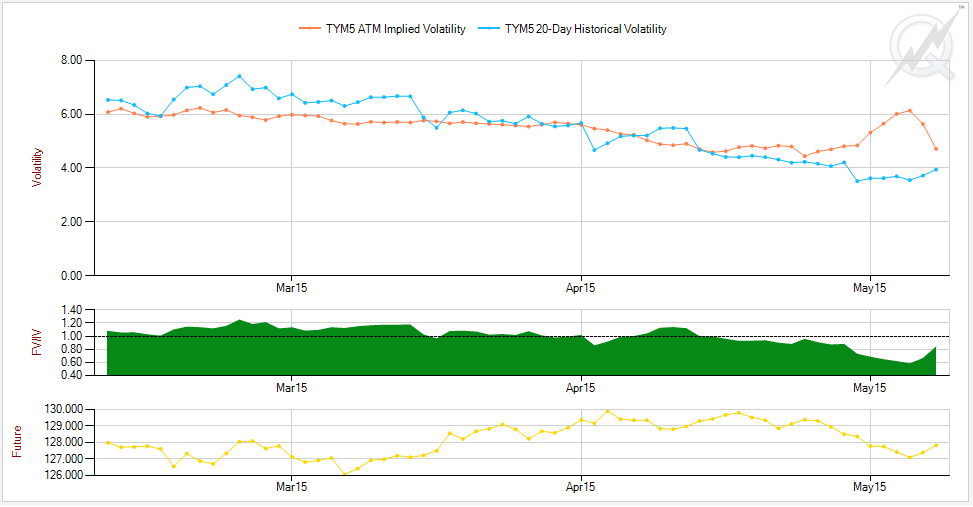

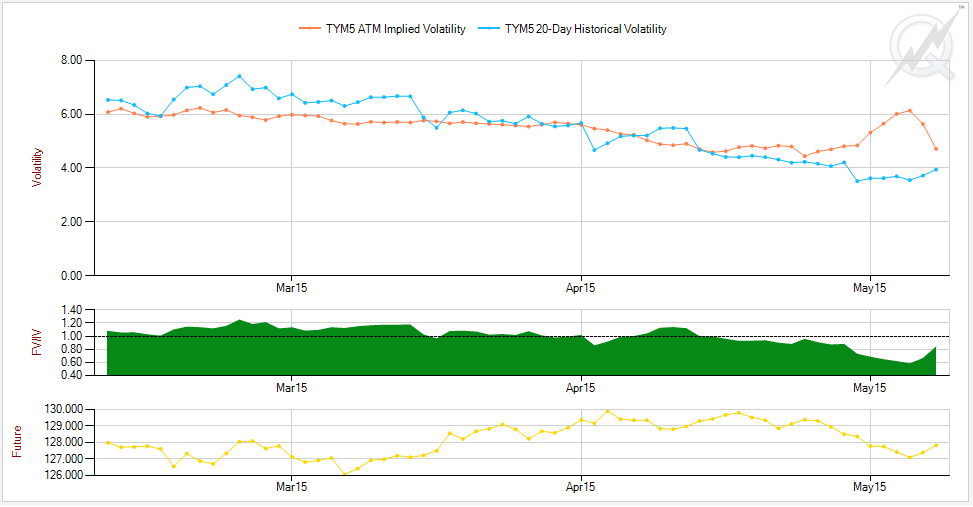

Calmer corn markets ahead? Volatility for March contract fell following Monday’s USDA report. @quikstrike1 pic.twitter.com/M2nAmU7HAv — CME Group (@CMEGroup) January 13, 2015 In wake of Monday’s USDA report, the CME Group tweeted a QuikStrike ATM Vol History...

by nhoward | Jan 13, 2015 | QuikStrike Help

QuikStrike was created to provide our users with fast, easy access to volatility information. The Vol Term Structure page makes it easy to compare at-the-money (ATM) implied volatility levels across all expirations on a single page. Using the Chart Settings and...

by nhoward | Jan 13, 2015 | QuikStrike Help

Have you started using the My Notes feature? Are you following our most recent Twitter activity? Do you keep items in your Watches? These are just a few of the ways that you can take advantage of the Sidebar in QuikStrike. Simply navigate to the right hand side of the...

by nhoward | Jan 12, 2015 | QuikStrike Help

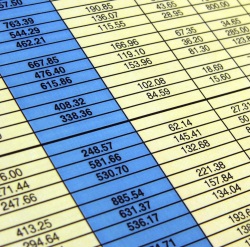

Remember when you initially logged into QuikStrike? The Standard Pricing Sheet was the first page you saw, and that’s not by mistake. The Standard Pricing Sheet, and all the other pricing sheets, are structured in a way that allow our users to manipulate them quickly...

by nhoward | Jan 8, 2015 | QuikStrike Help

In our most recent post, we referenced the Greek help in the QS.EDU section of QuikStrike. Understanding what each Greek value means and how they are affected by changes in the strike price, future price, volatility, days to expiration and interest rates is imperative...