by nhoward | Jan 15, 2015 | Options Info, QuikStrike News

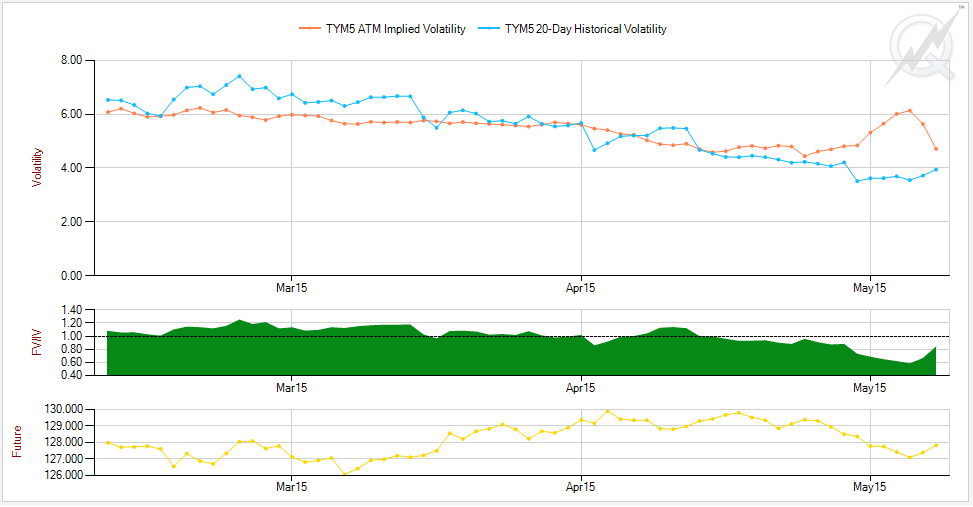

Calmer corn markets ahead? Volatility for March contract fell following Monday’s USDA report. @quikstrike1 pic.twitter.com/M2nAmU7HAv — CME Group (@CMEGroup) January 13, 2015 In wake of Monday’s USDA report, the CME Group tweeted a QuikStrike ATM Vol History...

by nhoward | Sep 25, 2014 | Options Info

http://traffic.libsyn.com/radionetwork/FOR14.mp3 Are you looking for some light listening to help you through the trading day? We’ve got just what you need! Nick has become a regular on the Futures Options Roundtable presented by The Options Insider. Below is a...

by nhoward | Aug 29, 2014 | Options Info

Joining the Futures Options Roundtable has become a regular occurrence for our CEO Nick Howard. In the latest edition, the group, led by Mark Longo, founder of The Options Insider Inc., covered a wide range of topics, including: The fluctuating Crude and Brent Crude...

by nhoward | Jul 11, 2014 | Options Info

“One thing that I think the people out there that are trading options might forget now is that the CME has the weeklies that are listed. The weeklies are going to tend to give you a pretty good idea of what people are thinking in the short term.” This was one of many...