Part of being a successful options trader is doing your homework. That means following the markets, understanding recent trends and being able to identify where the trade activity is taking place. One way to stay informed is to login to your QuikStrike account and check out the Open Interest page under the Summary Reports tab.

The Open Interest page displays an entire product sector in one view. On this page you’ll find:

- strike prices

- expirations

- calls, puts and combined (calls and puts) with the most Open Interest, Open Interest Change and Trade Volume from the previous trading day

Make note that open interest and volume on this page are updated each morning with a preliminary and then a final run at roughly 4:30a CST and 10:30a CST, respectively.

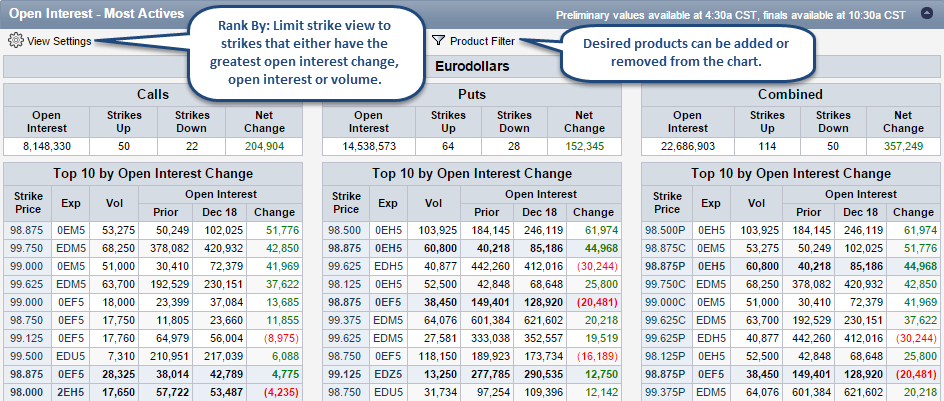

QuikStrike makes it easy to quickly sort through the data and find your desired information. However, before diving into the numbers, see the image below to understand ways to customize the page and get a general idea of the page layout.

The greater the open interest, the more activity in an option contract. In the Summary section, you can quickly view the open interest for calls, puts and combined total for a given product, as well as the net change from the previous day. Strikes up represents the number of strikes with increasing open interest, while strikes down denotes the number of strikes with decreasing open interest. Monitoring these numbers each day can help support/dispute a hypothesis about where the most activity in an expiration or strike is taking place.

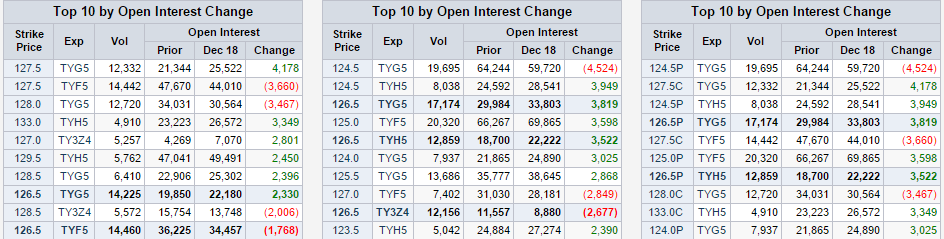

Directly below the Summary information are the Ranking columns for the product. Select either Open Interest, Open Interest Change or Trade Volume and use this section to see the most actives strikes given the chosen filter. We’ll use the 10 Year contracts as an example. The table below displays the Top 10 calls, puts and combined, from all active expirations, ranked according to their Open Interest Change.

It’s important to note that you can click on a particular strike price or expiration to dive deeper into the data and find more specific information on each without leaving the page. You’ll also notice that you can compare open interest in the Ranking column to the previous day, as well as view the trading volume.

Follow us on Twitter at @QuikStrike1 to see these reports every morning for a wide range of products. How does the prior days open interest and trading volume influence your decision-making? Tell us with an email to [email protected]. Happy Holidays!