by nhoward | Sep 15, 2015 | News, QuikStrike Help, QuikStrike News

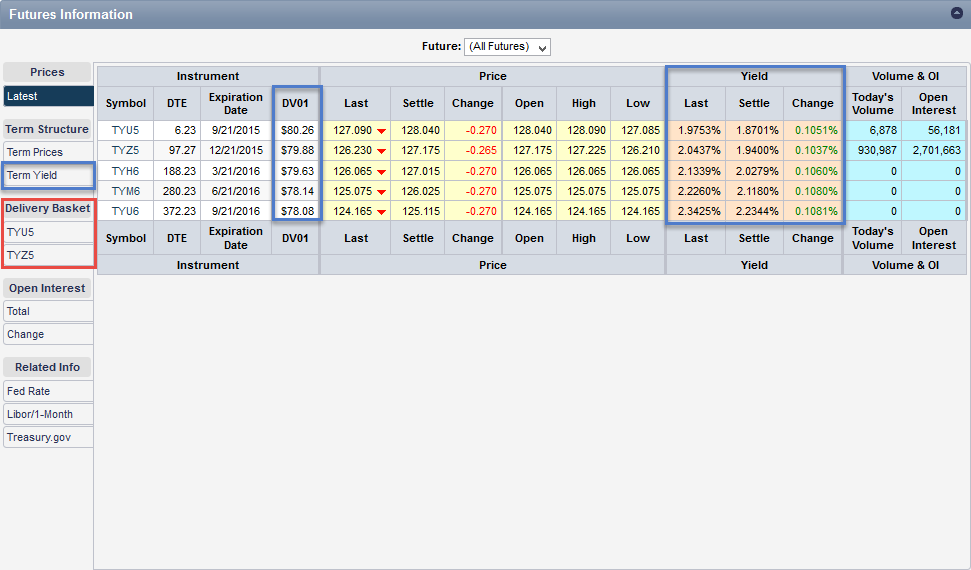

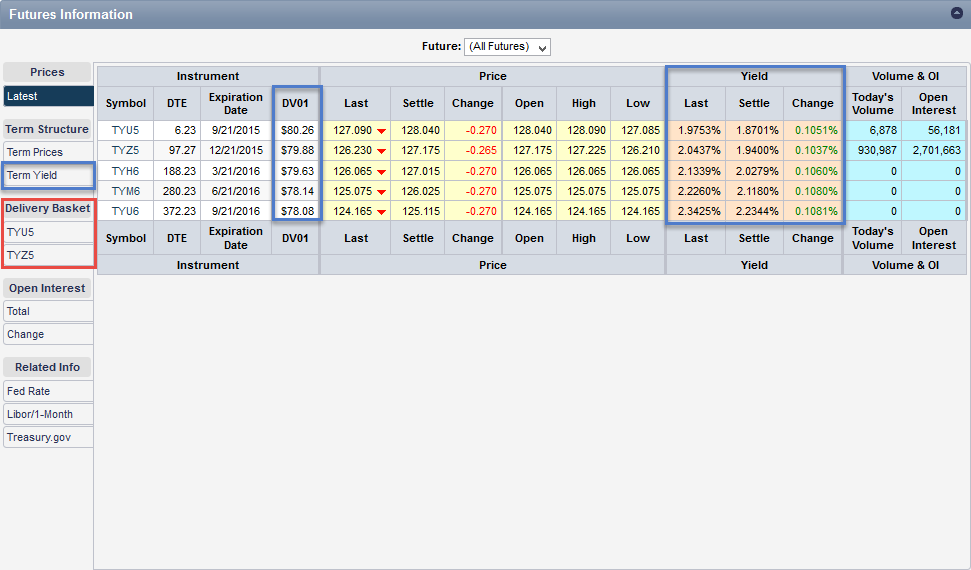

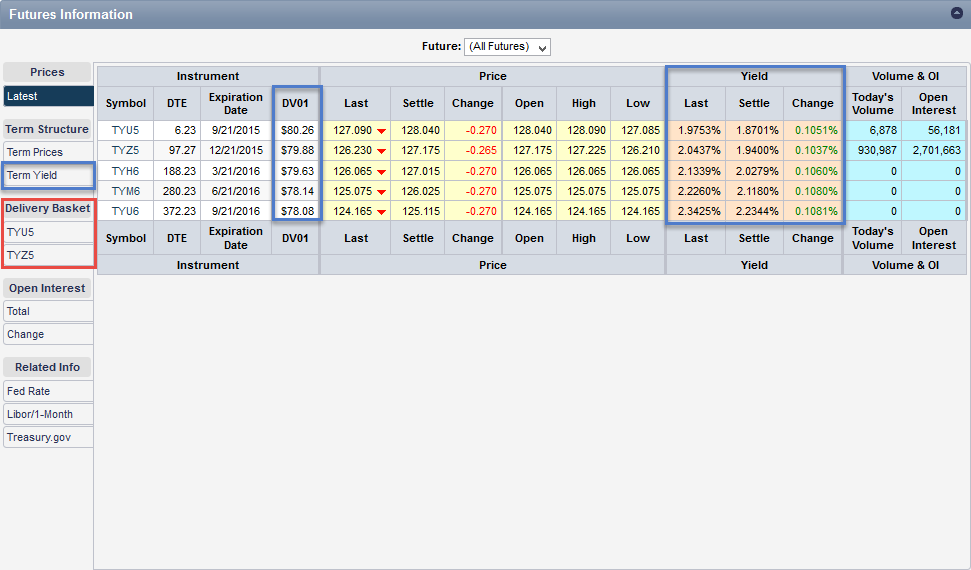

QuikStrike now displays the current and settle values for yield and DV01 (dollar value of a basis point) on the Futures Information page. The four callout boxes on the following graphic highlight the new treasury specific information. The DV01 has always been a...

by nhoward | Jan 27, 2015 | QuikStrike Help

QuikStrike puts a lot of information at your fingertips, and it’s important to know exactly what you’re viewing. Navigate to the QS.EDU tab and click the Contract Specs → Product Properties page to find tick data and scaling factors for an entire product group at a...

by nhoward | Jan 21, 2015 | QuikStrike Help

Our last blog post broke down the Strike Detail Sheet in QuikStrike. But as we mentioned in the post, there is another way to access all the information on the page. Clicking on (almost) any strike price in QuikStrike launches the Strike Detail popup: As you...

by nhoward | Jan 21, 2015 | QuikStrike Help

If you’ve read the blog post about our Standard Pricing Sheet, it’s time to try out our Strike Detail Sheet. Now that you know how to find call, put and straddle prices, view Greek values associated with those positions and manipulate inputs in a theoretical pricing...

by nhoward | Jan 13, 2015 | QuikStrike Help

QuikStrike was created to provide our users with fast, easy access to volatility information. The Vol Term Structure page makes it easy to compare at-the-money (ATM) implied volatility levels across all expirations on a single page. Using the Chart Settings and...

by nhoward | Jan 13, 2015 | QuikStrike Help

Have you started using the My Notes feature? Are you following our most recent Twitter activity? Do you keep items in your Watches? These are just a few of the ways that you can take advantage of the Sidebar in QuikStrike. Simply navigate to the right hand side of the...