by nhoward | Sep 15, 2015 | News, QuikStrike Help, QuikStrike News

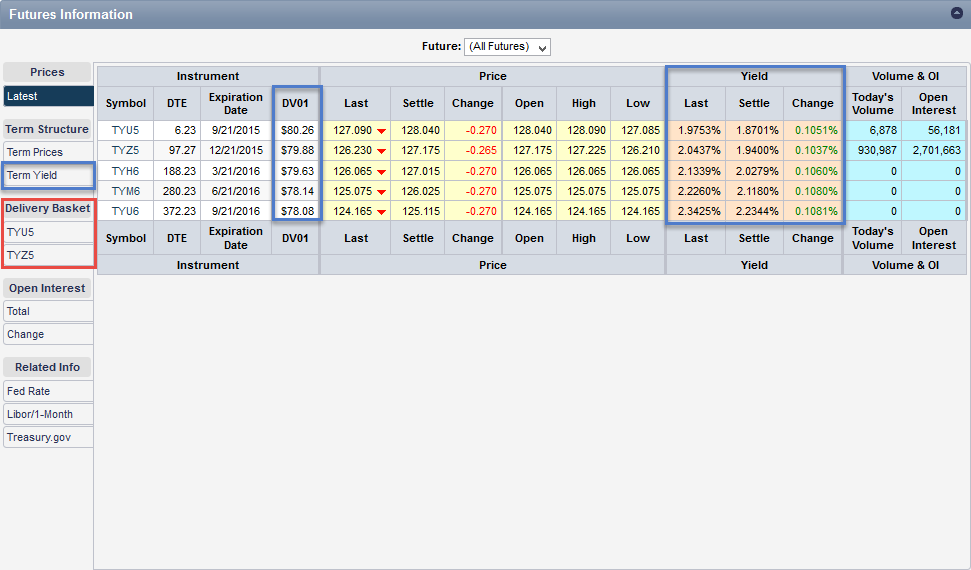

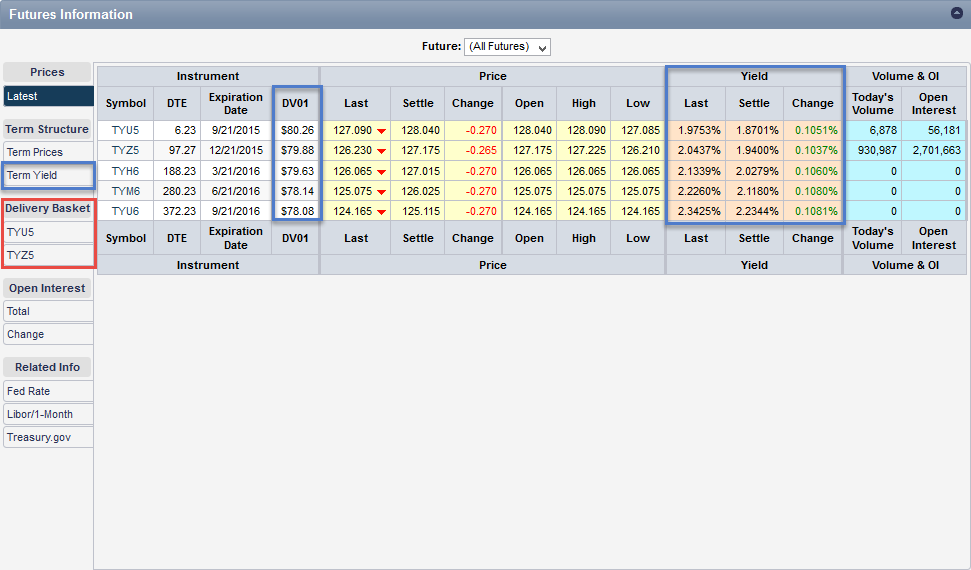

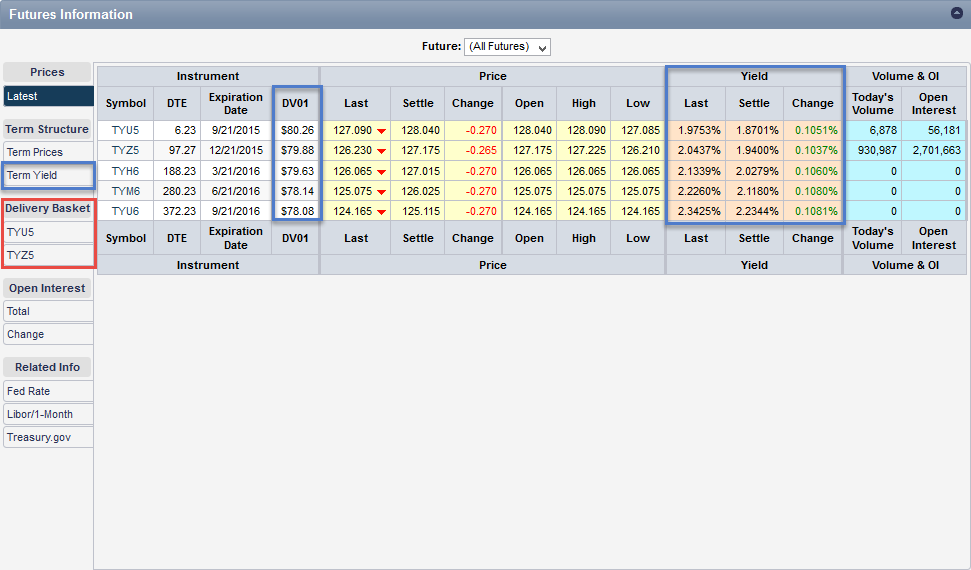

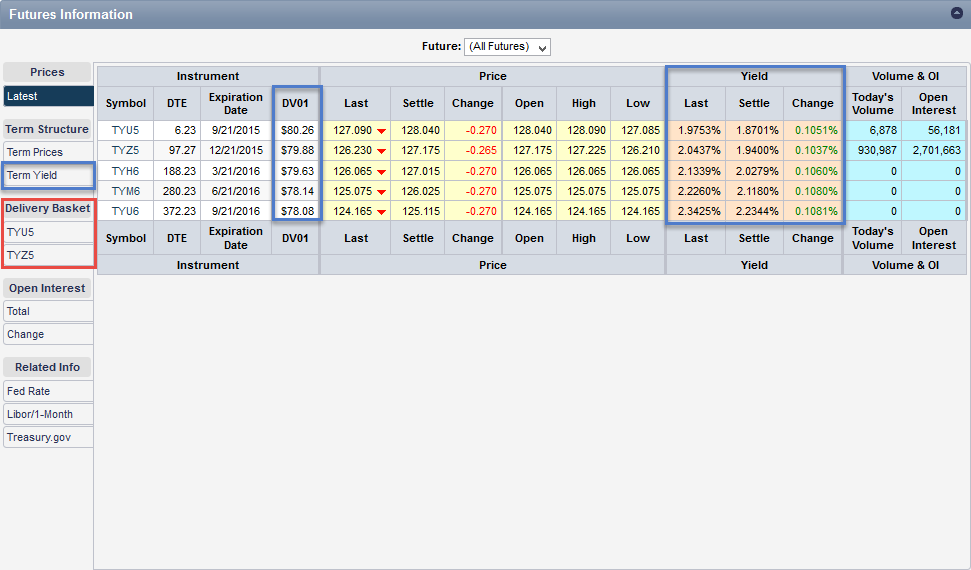

QuikStrike now displays the current and settle values for yield and DV01 (dollar value of a basis point) on the Futures Information page. The four callout boxes on the following graphic highlight the new treasury specific information. The DV01 has always been a...